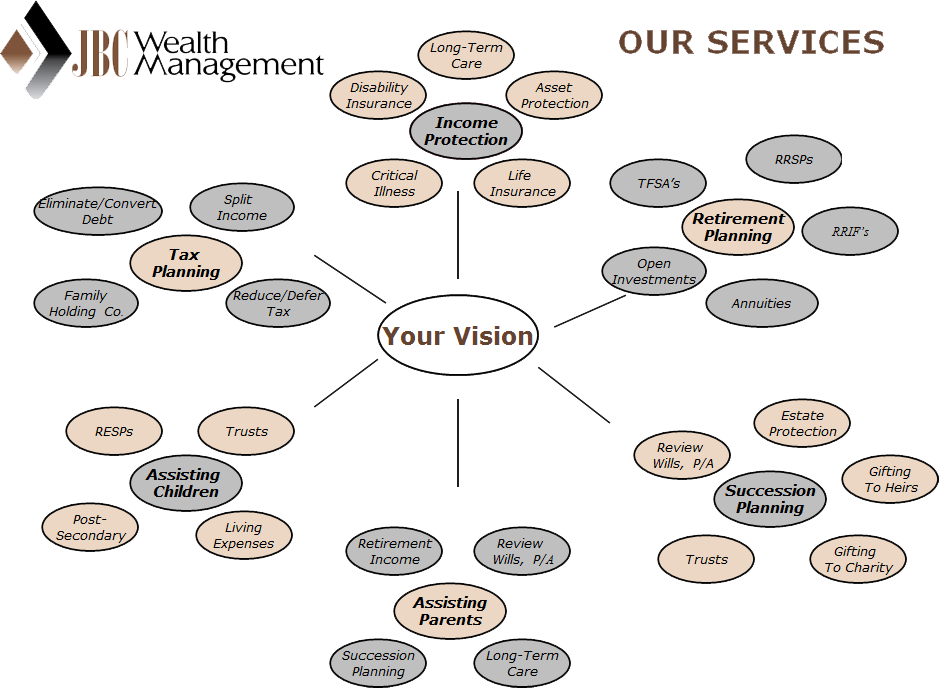

Income Protection – you work hard for your money so make sure it is protected. We are not able to predict when things go wrong in life. Being prepared with an income protection plan is a necessity to ensure that you and your loved ones will be taken care of regardless of the situation presented.

Retirement Planning – Saving money for your future is a major focus for every Canadian. It also brings about many questions. How do I pay for today’s expenses and also save money to pay for tomorrow’s expenses? When will I have enough to retire? Will I get to keep the same standard of living? Can I afford to buy a vacation property? Our

Succession Planning – Many of us have a difficult time discussing what will happen when we are gone. This is a major area of financial planning to ensure you have a plan and that your wishes are carried out as you intended. We will guide you through this process by working with you and your executor to make sure that everything runs smoothly.

Assisting Parents – as children, we spend quite a bit of time and energy worrying about our parents and whether they will have financial freedom in retirement. Today, we have many tools available to help our parents maintain their standard of living while keeping their independence.

Assisting Children – Kids are expensive. How do you prepare for the costs of education, activities and helping your children prepare for independence? At JBC, we incorporate this into your financial plan. Whether you are Mom and Dad, Grandma and Grandpa or Aunt and Uncle, we have strategies to give the children the best chance at success.

Tax Planning – Taxes are an ever-changing part of the planning process. JBC Wealth will help you stay ahead of the rule changes and be able to adapt your plan to take advantage of the benefits available to you.